DHAKA, BANGLADESH – October 14, 2025 — The price of gold in Bangladesh has reached a stunning, all-time high today, with the cost of the best quality 22-Karat gold crossing the BDT 2.13 lakh mark per bhori (11.664 grams).

The Bangladesh Jewellers’ Association (BAJUS) announced a steep increase of BDT 4,618 per bhori, officially setting the new price for 22-Karat gold at BDT 2,13,719 effective from Tuesday, October 14, 2025. This historic hike comes as the local market reacts to a continuous surge in the price of refined acid gold and heightened investment demand.

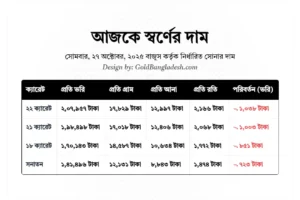

New Gold and Silver Prices Effective Today

The price adjustment, which is the 64th revision by BAJUS this year, reflects unprecedented pressure from the international bullion market, where gold recently smashed the $4,100 per ounce barrier due to global geopolitical and economic uncertainties.

| Product (Per Gram) | Price (BDT) | Product (Per Bhori / 11.664g) | Price (BDT) |

| 22-Karat Gold (CADMIUM/HALLMARKED) | 18,323 | 22-Karat Gold | 2,13,719 |

| 21-Karat Gold (CADMIUM/HALLMARKED) | 17,490 | 21-Karat Gold | 2,04,003 |

| 18-Karat Gold (CADMIUM/HALLMARKED) | 14,991 | 18-Karat Gold | 1,74,855 |

| Traditional Gold | 12,476 | Traditional Gold | 1,45,520 |

| 22-Karat Silver (CADMIUM/HALLMARKED) | 532 | 22-Karat Silver | 6,205 |

Note: Prices above exclude the mandatory 5% VAT and minimum 6% jeweller’s wage/making charge.

Why Are Gold Prices Skyrocketing in Bangladesh?

The unprecedented price spiral is being driven by a perfect storm of global and local factors:

- Global Bullion Rally: International gold prices are at record highs, fueled by safe-haven demand amidst new US-China trade tensions and expectations that the US Federal Reserve will aggressively cut interest rates in the coming months.

- Central Bank Gold Buying: Major central banks worldwide, including China and India, are aggressively diversifying their reserves away from the US Dollar and into gold, creating a massive, sustained demand.

- Local Currency Depreciation & Inflation: The persistent depreciation of the Bangladeshi Taka (BDT) against the US Dollar (USD) and sustained domestic inflation make imported gold—which is the primary source of supply—significantly more expensive in local currency terms.

- Local Demand: Despite the high cost, local demand remains resilient, especially ahead of the peak wedding and festive season (October-December), further tightening market supply.

Industry analysts warn that sustained high prices, particularly when compounded by the cost of VAT and making charges (pushing the final price of 22-karat jewellery over BDT 2.25 lakh per bhori), are likely to dampen discretionary purchases in the mid-to-lower market segments. However, the metal’s status as a store of value continues to drive investment.