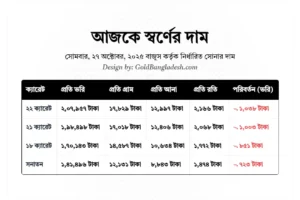

The price of gold in Bangladesh is constantly rising, reaching new record highs. Many wonder why this precious metal keeps getting more expensive, affecting the Gold Rate Today and the cost of buying Bhori (Tola) jewelry.

The truth is that global market forces are pushing up gold prices worldwide. For anyone looking at Investment in Gold or planning a purchase, understanding these drivers is essential.

Here are the 5 main reasons why gold is getting costlier:

1. Global Uncertainty & Safe-Haven Demand (The Fear Factor)

Whenever there are wars (like the conflicts in the Middle East or Europe), trade disputes, or political crises around the world, investors get nervous. Gold is traditionally seen as a “safe haven” asset—a reliable place to put money when paper currencies and stocks feel risky. This high level of global tension forces investors to buy gold, driving up demand and, consequently, the Gold Price Bangladesh.

2. Record Buying by Central Banks

Central banks of many countries, especially emerging economies like China, India, and Turkey, are buying record amounts of physical gold. They do this to diversify their national reserves and reduce their reliance on the U.S. Dollar, which they view as a potential risk. This institutional, large-scale demand acts as a massive and constant push, keeping the base price of gold extremely high.

3. Weaker US Dollar & Rate Cut Hopes

Gold is traded internationally in U.S. Dollars.

- A Weaker Dollar: When the U.S. Dollar loses value against other currencies, it makes gold cheaper for people holding currencies like the Taka or Euro. This increased affordability leads to higher international demand, which raises the global price.

- Interest Rate Cuts: When the US Federal Reserve (Fed) is expected to cut interest rates, it makes interest-bearing assets (like bank deposits or government bonds) less attractive. Since gold does not pay interest, its appeal grows stronger compared to the lower returns offered by savings.

4. Protection Against Inflation (The Currency Hedge)

Inflation is when the purchasing power of money decreases (goods and services get more expensive). Gold is considered a great hedge against inflation because it is a physical asset that cannot be printed by a government. Investors buy gold to protect their wealth from the erosion of value in their local currency, making it a popular choice for long-term Investment in Gold when prices rise.

5. Strong Investment Inflows (ETF Demand)

Big financial institutions and large investors are putting billions into gold-backed Exchange-Traded Funds (ETFs). ETFs are ways to invest in gold without holding the physical metal. High demand and massive inflows into these funds signal strong confidence in gold’s rising trajectory, creating a snowball effect in the market. This financial demand adds significant upward pressure on the price, much like jewelry or coin demand in Bangladesh does.

For those in Bangladesh, these global factors directly translate into higher Gold Rate Today listings. As long as global uncertainty, high inflation, and central bank buying continue, experts predict the gold price will likely remain elevated.